Market Planning

Identifying the Ideal Market Areas for a National Insurance Company

See how location, paired with other data, can help an organization make strategic market expansion decisions.

A national insurance company is interested in entering the southeastern United States with a homeowners insurance product. Using a variety of data sources and GIS location analysis, the MarketSource team can identify markets with the greatest opportunity.

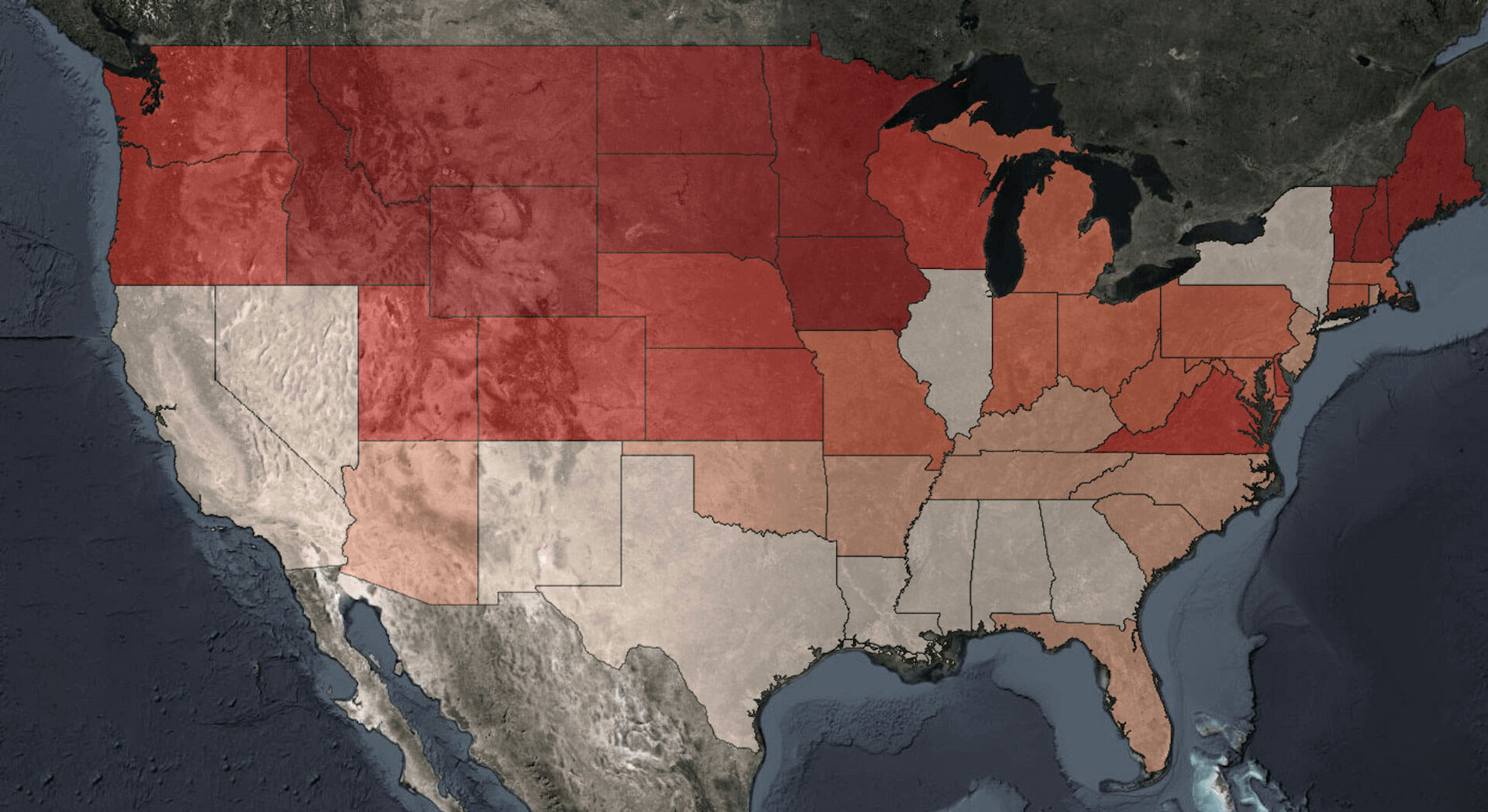

Using Census data and the American Community Survey, we find that Georgia has a low percentage of homeowners who carry homeowner’s insurance.

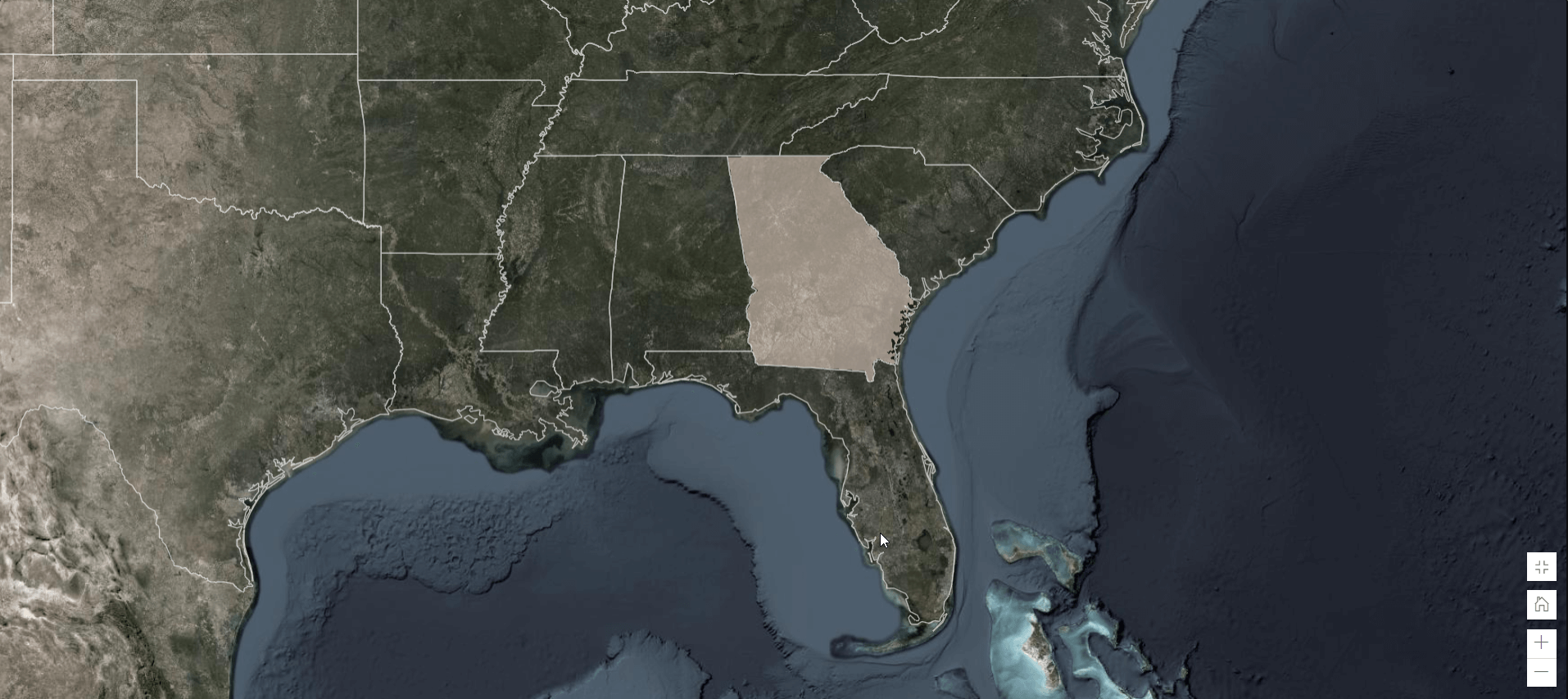

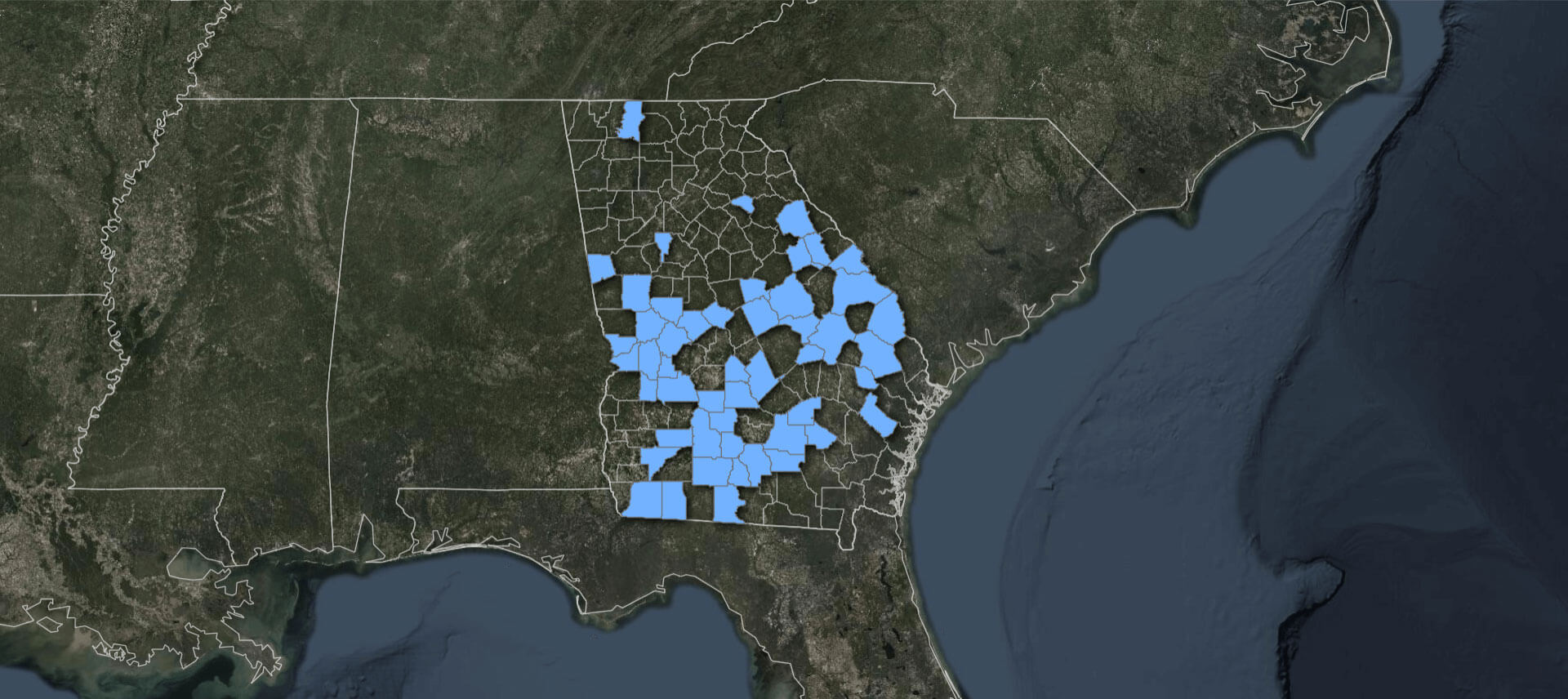

Analyzing the penetration of homeowners insurance at the Congressional District level reveals that South Georgia has the greatest potential.

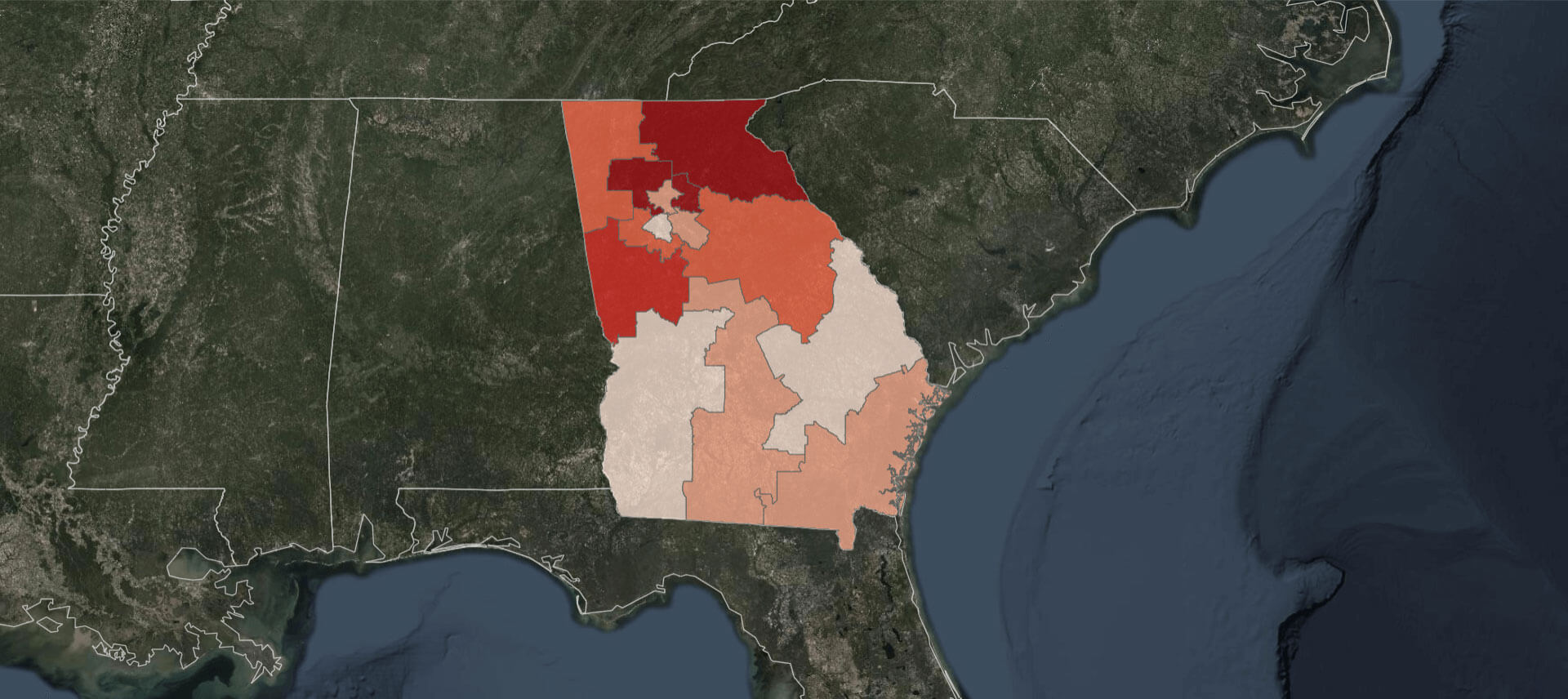

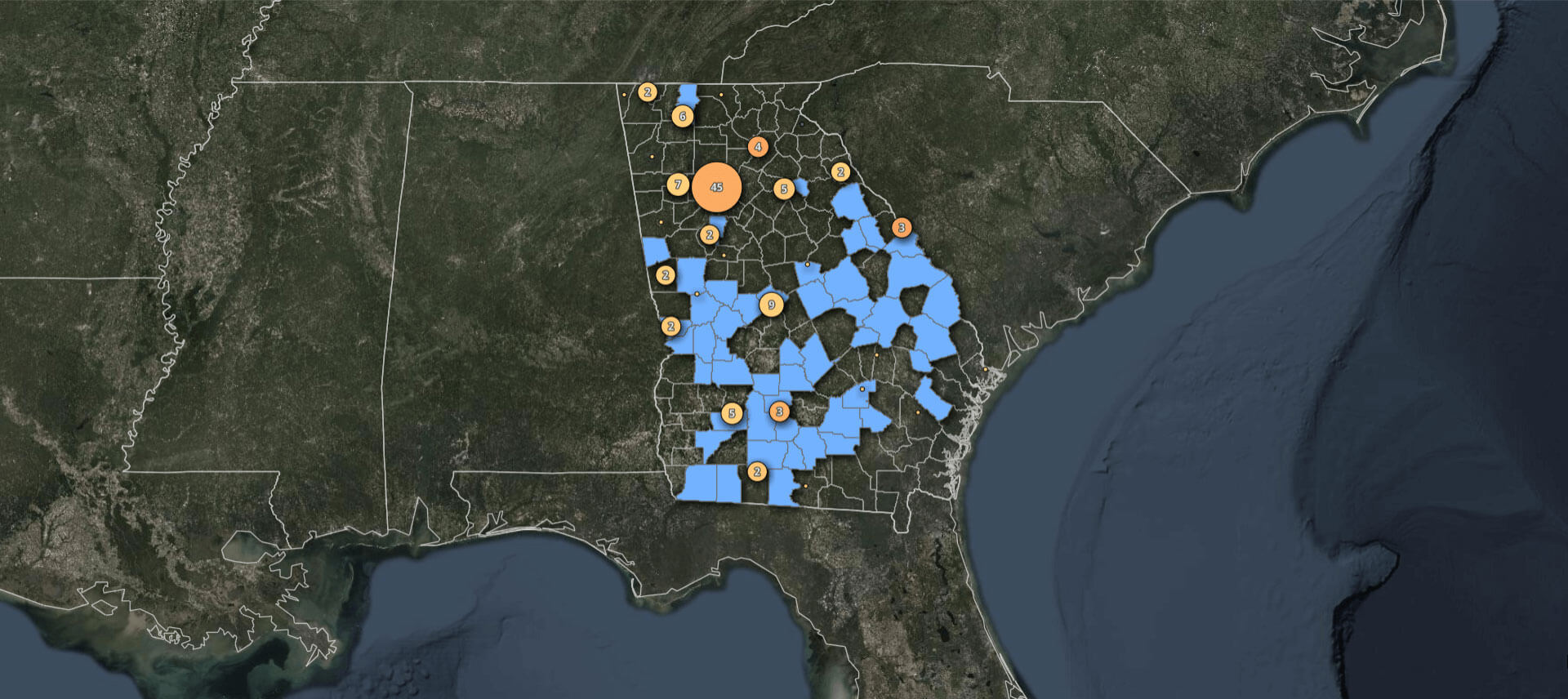

Overlaying demographic and consumer behavior characteristics reveals areas with the greatest purchase propensity.

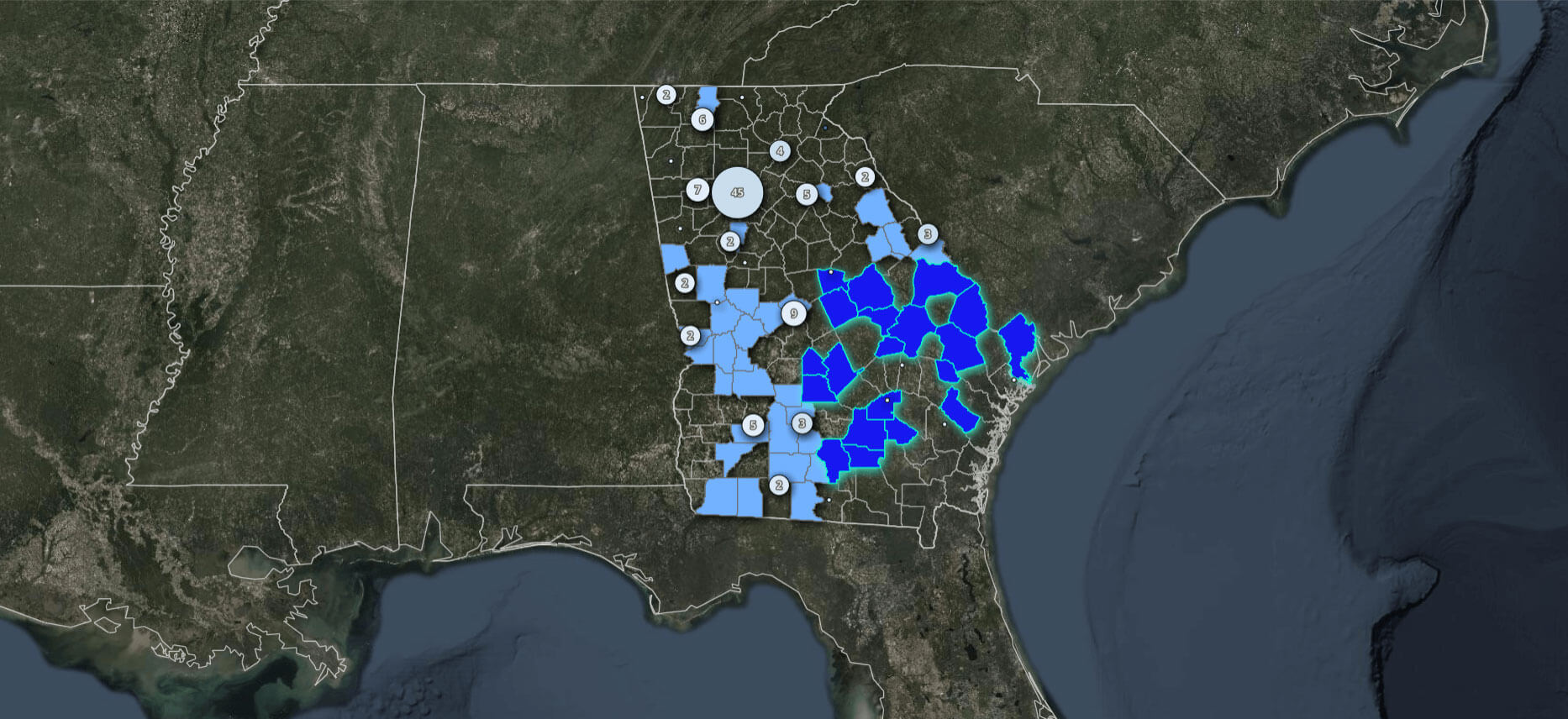

An additional overlay of competition, using multiple data sources, reveals areas with low-or-no competitive penetration.

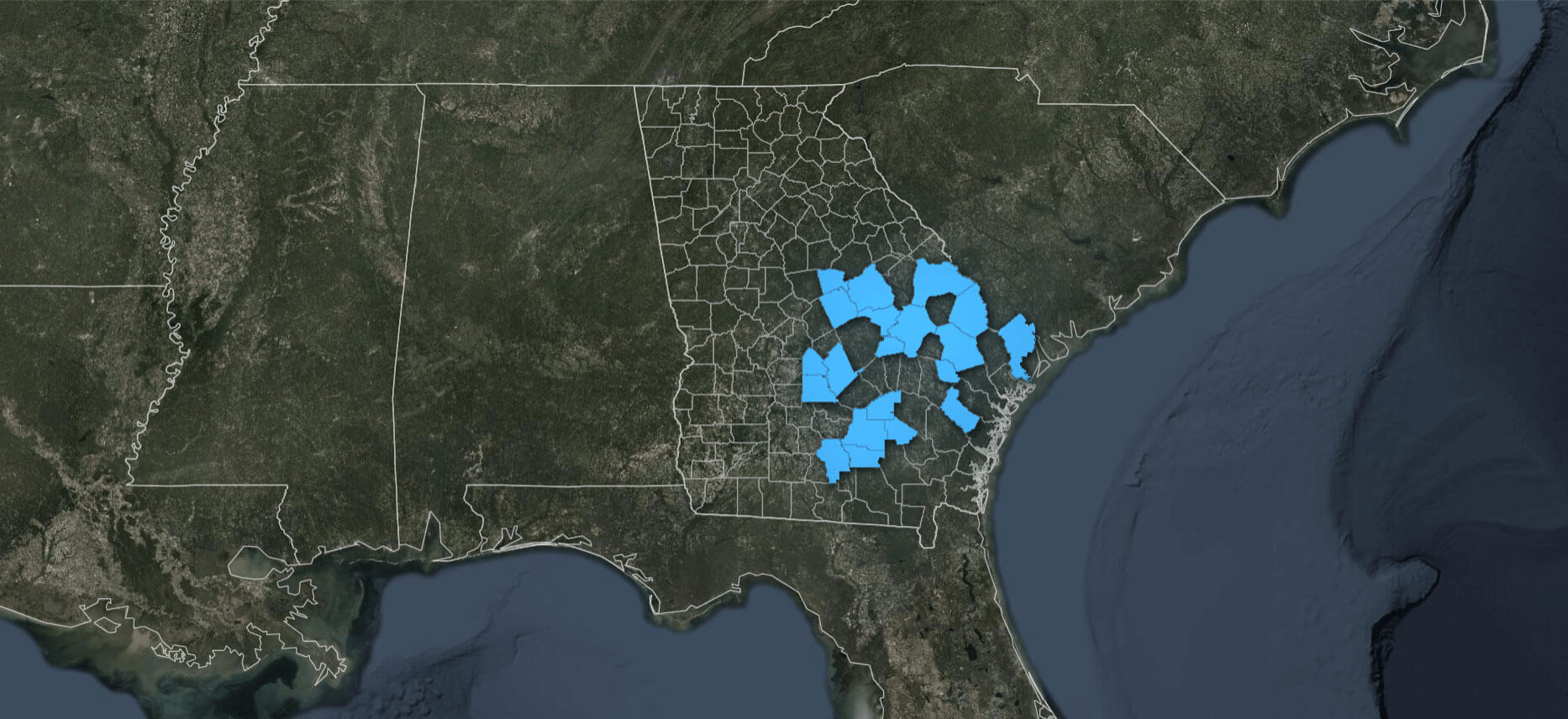

These are the recommended markets the insurance company will enter with their homeowner’s insurance product.

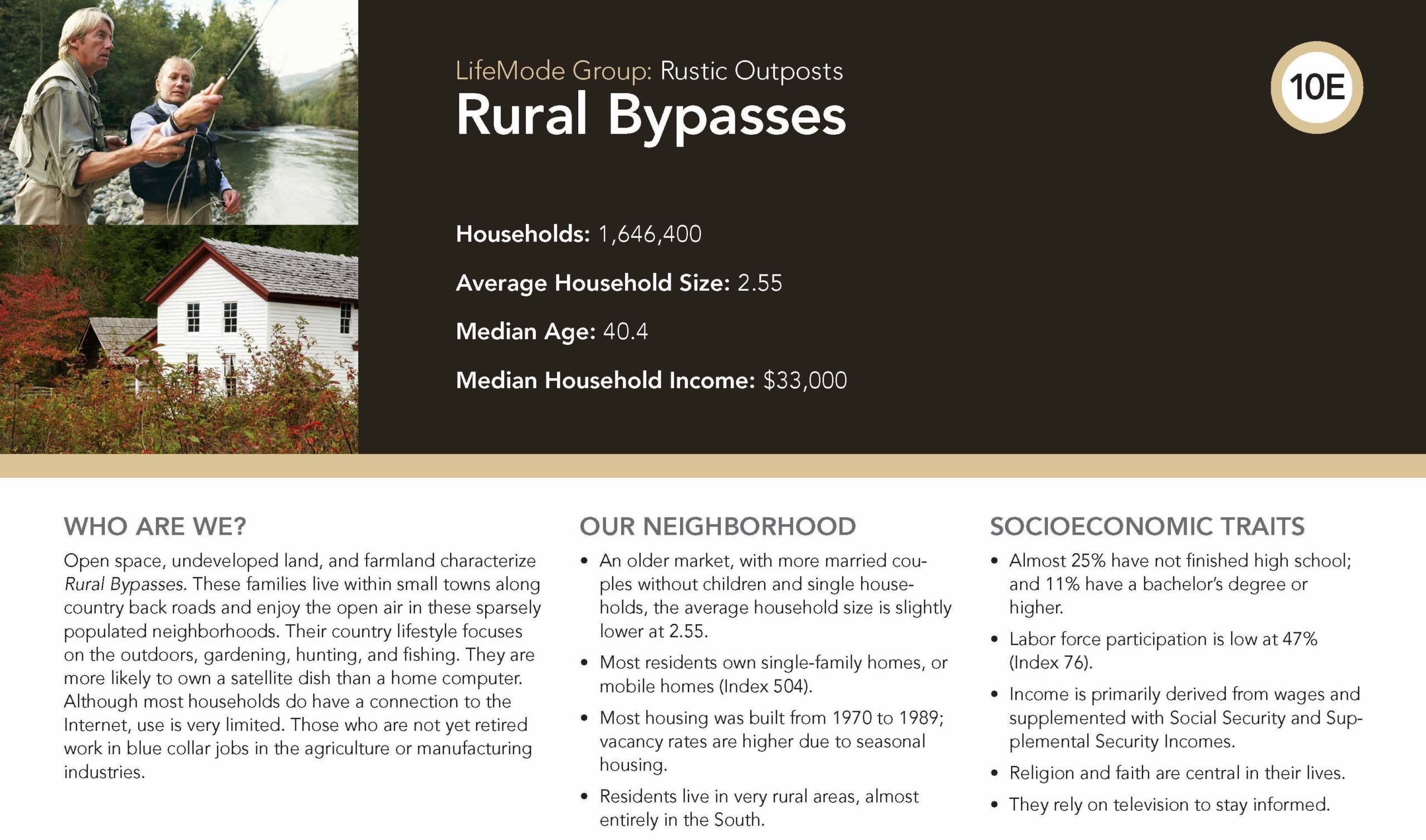

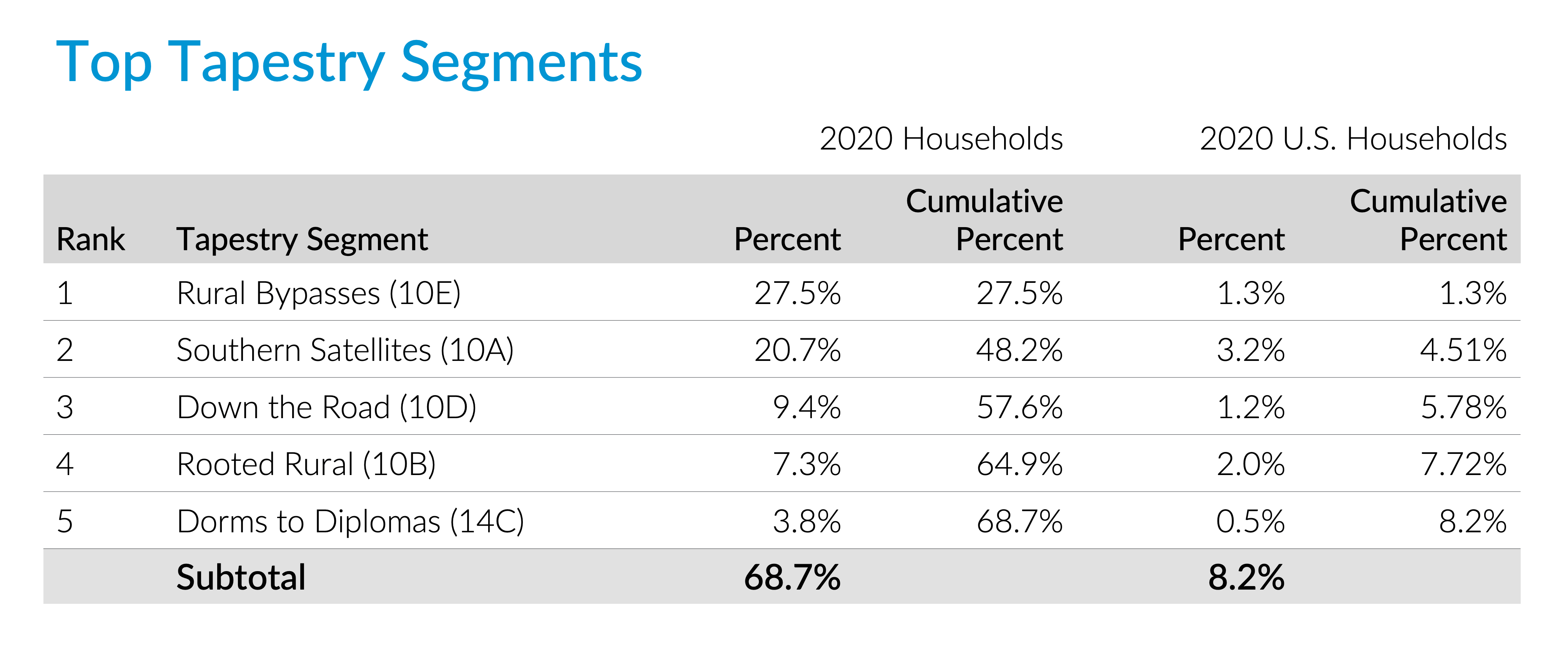

Using Tapestry Segmentation data, we can identify the distinct lifestyles and behavior patterns of residents in our selected markets. By understanding commonly shared demographic, psychographic and behavioral traits within neighborhoods, the insurance company can design relevant and effective marketing and sales strategies to launch its insurance product.

A national insurance company is interested in entering the southeastern United States with a homeowners insurance product. Using a variety of data sources and GIS location analysis, the MarketSource team can identify markets with the greatest opportunity.

A national insurance company is interested in entering the southeastern United States with a homeowners insurance product. Using a variety of data sources and GIS location analysis, the MarketSource team can identify markets with the greatest opportunity.

A national insurance company is interested in entering the southeastern United States with a homeowners insurance product. Using a variety of data sources and GIS location analysis, the MarketSource team can identify markets with the greatest opportunity.

A national insurance company is interested in entering the southeastern United States with a homeowners insurance product. Using a variety of data sources and GIS location analysis, the MarketSource team can identify markets with the greatest opportunity.

A national insurance company is interested in entering the southeastern United States with a homeowners insurance product. Using a variety of data sources and GIS location analysis, the MarketSource team can identify markets with the greatest opportunity.

A national insurance company is interested in entering the southeastern United States with a homeowners insurance product. Using a variety of data sources and GIS location analysis, the MarketSource team can identify markets with the greatest opportunity.

A national insurance company is interested in entering the southeastern United States with a homeowners insurance product. Using a variety of data sources and GIS location analysis, the MarketSource team can identify markets with the greatest opportunity.

Among all Tapestry segments, nearly 70% belong to 5 segments.

We can see key neighborhood demographics and socioeconomic traits of each group.

With this information, the insurance company can create relevant and highly targeted messaging.

Our GIS professionals Know How to Use Location to Make Intelligent Decisions and Drive Sustainable Growth.